As silver moves to new highs, silver stocks have underperformed the metal. Is there any fundamental significance to this disparity for an investor, or have silver stocks routinely lagged price increases in silver bullion?

Theoretically, silver producers should experience a significant degree of earnings leverage as the price of silver appreciates and the stocks would be expected to outperform the metal. A look at the long term picture, however, shows that this is not the case.

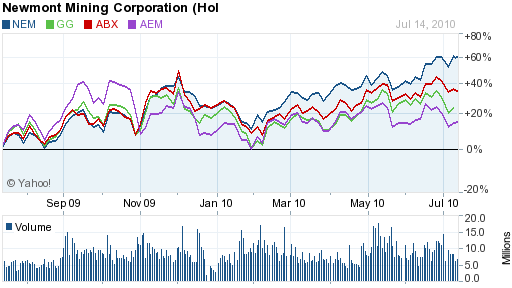

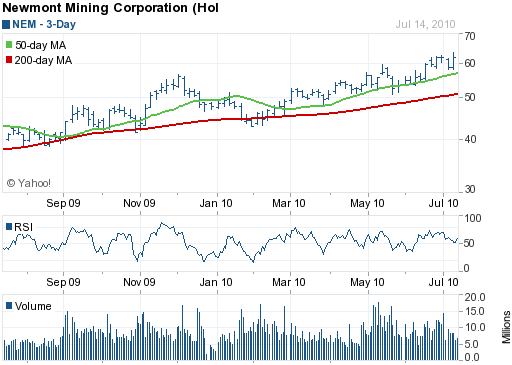

While silver has increased approximately 50% from the $20 per ounce range in early 2008, the stocks of many major silver producers are below prices reached in 2008. For example, since early 2008 the price of Hecla Mining (HL) has decline 14% from $12 to $10.27, the price of Pan American Silver (PASS) has decline 12% from $40 to $35.40 and the price of Silver Standard Resources (SSRI) has declined a massive 36% from $40 to $25.55. An exception to this trend was Silver Wheaton Corp (SLW) which increased by 83% from $20 to $36.77.

If one was lucky enough to pick SLW, the stock outperformed the metal. A basket of the four stocks cited would have yielded a loss of 3.6% since early 2008. So much for the theory of earnings leverage with silver stocks.

Using the iShare Silver Trust (SLV) as a proxy for the metal also depicts the under performance of silver stocks compared to the bullion.

The risk of equity ownership compared to holding silver bullion is also greatly magnified when the price of silver declines. During the financial crisis of 2008, as silver declined from $20 to $10, silver stocks were utterly crushed. The price of Hecla Mining, Silver Wheaton and Silver Standard Resources dropped approximately 85% and the price of Pan American Silver Corp dropped 75%. Leveraged worked as expected on the downside but failed to produce superior returns when silver prices increased.

From a very long term perspective, silver stocks yielded a slightly greater return over the metal if the right stocks were chosen at the right time. Investing in the silver stocks cited above at the exact lows during 2000-2001 produced marginally higher returns over the bullion but with greater risk during periods when silver prices dropped.

As a long time holder of silver bullion and coins, I would expect a continued explosive move upward over time in the price of silver. The historical high of $48.70 reached in January 1980 should be easily exceeded. A price greater than the inflation adjusted historical high of $130 per ounce would not be surprising. The open question is, when silver soars, will stocks or the bullion outperform?

For those who find the process of physically holding silver cumbersome, ownership in the iShares Silver Trust (SLV) is an excellent proxy.

Disclosures: Long silver bullion, SLV and SLW