Debt Is The Greenspan Legacy

Alan Greenspan, former Federal Reserve Chairman, today expressed his concern about the level of the US national debt.

Sept. 16 (Bloomberg) — Former Federal Reserve Chairman Alan Greenspan said he’s worried that lawmakers will hamper U.S. central bank efforts to rein in its monetary stimulus, and that inflation might “swamp” the bond market.

The former Fed chief, who counts Deutsche Bank among his clients, also warned that the U.S. must rein in its “very dangerous” level of debt, citing the threat of increased issuance of Treasuries undermining the dollar.

Greenspan said one threat to Treasuries is the “very dangerous” level of U.S. national debt. “We’ve got to confront that issue immediately,” he said.

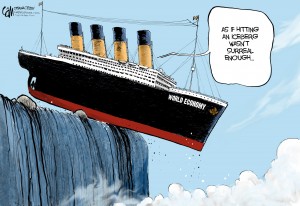

Mr Greenspan’s sudden concern about the buildup of the US national debt seem to imply that this situation occurred after his long tenure (1987 – 2006) as Federal Reserve Chairman. The facts speak otherwise. During the Greenspan era of easy money and easy credit, the US national debt had already spiraled out of control, increasing from approximately $1 trillion to $9 trillion.

Did Mr Greenspan not notice what was happening during his two decade reign at the Federal Reserve? Mr Greenspan’s current concerns about the explosion of US debt seem to be a disingenuous attempt at historical revisionism to obfuscate his central role in the creation of the greatest debt bubble in history. For Mr Greenspan to suggest that he had nothing to do with fostering the current “very dangerous” level of US national debt is like trying to argue that Hitler had nothing to do with World War II.

Mr Greenspan also commented on the potential risk of inflation:

“It’s the politics in the United States that worries me, whether the Congress will basically feel comfortable” with the Fed withdrawing its stimulus, Greenspan said in a broadcast to Tokyo clients of Deutsche Bank Securities Inc. today. He later said that “if inflation rears its head, it will swamp long-term markets,” referring to bonds.

Greenspan, speaking via videoconference from Washington, indicated that successor Ben S. Bernanke and his fellow Fed policy makers have until next year before inflation will present a danger.

Based on Greenspan’s past poor record of not recognizing the inherent dangers of overleverage, it is highly likely that he is now missing the big picture again. We are now experiencing a post bubble credit collapse of epic proportions. The deleveraging process that we are now witnessing will not unwind 20 years of reckless credit expansion in one year. If Greenspan fears inflation, it’s a good bet that the real danger is the continuation of a deepening deflation.

Commenting on the need for a systemic risk regulator, Mr Greenspan noted that “I’m not in favor of a systemic-risk regulator because I don’t think it’s feasible. I think we have to recognize that there are limits to what we can do.” No argument with that statement Mr Greenspan.