Every day there are many great posts on the web. Here are some from the past week that merit a full read. The listing order is random.

Karl Denninger does not play nice in his counter point to a NY Times article about “mortgage relief” tax dollars going to those who were fiscally irresponsible and should have never owned a house in the first place. The really galling part of the Times story was their tacit approval of the sense of entitlement exhibited by those who deserve nothing.

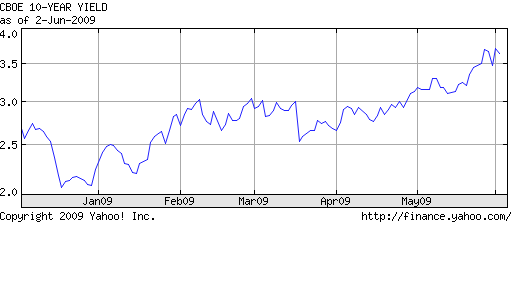

With a lot of hysteria over the increase in long interest rates recently, this is a good measured analysis that looks at the history of rates and the implications for investors holding bonds.

Obama’s Deficits Put US Credit Rating At Risk

The huge US deficits and debt won’t matter until it does matter. No one doubts that the US will pay on obligations, but what will they pay with? Markets perceptions of risk can change quickly, upsetting any perceived economic recovery.

The growing budget deficits on a State level have been getting some serious notice lately but have not reached the crisis stage. How exactly does the Fed monetize this problem? If the States have to cut budgets enough to match spending with drastically declining tax receipts, this will more than wipe out any stimulus spending at the Federal level.

Some great charts with not so great implications for the world economies. The policy response this time is different but will it make any difference?

Fed In Foreclosure, Mortgage Rates Battered

Some discussion on the Fed’s losing battle to manipulate rates lower by buying treasuries and mortgage debt. Investors are not amused and are voting with an avalanche of sell orders in the long government debt markets. So what does the Fed do next?