Reality Becoming Impossible To Ignore

There still appears to be a serene sense of calm by the American public. They hope that the government will be able to solve our economic crisis in short order and restore to us the American dream of nonstop prosperity.

For those who have lost their jobs, the American dream is over. For those who have seen their equity and real estate wealth disappear, there is growing uncertainty that asset values will recover any time soon. Those who have ignored or denied reality will lose the most since they are the least prepared to deal with the extended economic nightmare we are facing.

Can the world’s governments put Humpty Dumpty back together again? For further consideration of where we are and where we might be headed, the following links are well worth the read.

It appears as though we are on the cusp of the next (of several) phases in this global economic crisis. The phase we just went through lasted roughly from August of 2008 through the first of this month. This phase included identifying our problems, getting through the smoke and mirrors, initial false promises of recovery, and the beginning of finger pointing among the nations. It was a phase where the crisis was centered on the banking system and the financial economy. It was a phase where the majority (but not all) of the problems that we are facing was revealed.

It is time now for the next phase. This is the phase where the people of this country and of the entire world begin to awaken to the reality of our present situation, and that reality begins to find its way into world markets. This is the phase where the depth and breadth of the problems we face will be revealed. With this revelation, any remaining hopes of a quick recovery will be dashed on the rocks of reality, and people will begin to actually deal with the crisis. It is a phase where the crisis deepens, not just in the financial economy and the banking system, but in the real economy and in the very life blood of all economic activity – the currency markets.

It is during this phase where the character of the nation will begin to be tested.

Increasingly I am becoming aware of a growing group of people who are ready and willing to stand for the principles given to us by our Founding Fathers. These include our national sovereignty, the rights of the states, limited federal government, sound money, the ability of people to express their faith openly, and the very idea of freedom and liberty for “we the people.” We are entering a time period where the DNA will be set for how this battle will be fought as new leaders arise within this group. And how it is fought will be the determining factor of whether or not it will be successful. This is the history we are poised to begin making in the months ahead.

Debt Addiction Depression Destruction

America is so hopelessly addicted to credit that unlike the family that understands its addiction to heroin has destroyed everything they once had, Americans don’t even yet understand they are addicted.

Americans today view the on-going credit contraction much as heroin addicts view the disappearance of heroin—with anxiety, dread and fear. Americans are so addicted to the flow of credit from the Federal Reserve that they no longer believe they can live without it.

The unnatural availability of credit causes an unnatural expansion of economic activity. This “economic expansion” is later followed by an “economic contraction” wherein the debts introduced by the unnatural availability of credit cannot be repaid. The business cycle is as unnatural as the monetary system upon which it is based.

While it is now too late to undo what has been done, it is not too late to prepare for what is about to happen, a financial collapse that will exceed even the suffering caused by the Great Depression. History is now moving quickly and the end of this epoch is near.

Although the economic collapse is now in motion, there is still time to preserve what savings you still have. This is the end of a three hundred year system of credit and debt based on the debasement of money, a system now in its final stages. As the crisis moves forward, the time left in which to act will disappear. Soon, it will be too late to do so.

Today, two years later, although the collapse has started it has only just begun and cannot be stopped until it has fully run its course; and when it has done so, the global economic, social and political landscape will be dramatically altered. Wall Street was first, Main Street is next and, soon, everyone’s street will be affected.

Several years ago – I don’t remember the date – I read an interesting comment: “The great boom that the world is enjoying, is in effect an enormous shorting of cash and going long on debt. Eventually, there will be a short squeeze on cash which will have to be covered by going long on cash and shorting debt.”

Deflation and Depression are actually a manifestation of a massive short squeeze on cash in an attempt to reduce a gross and unsustainable long position on debt.

The Deflation and Depression will continue until the long position on debt is reduced. The long position on debt in the world is so massive, that it will only be reduced by equally massive defaults.

Delaying the inevitable will only drag out the agony of Deflation and Depression for many years. Bringing all the massive liabilities of the banking system onto the Treasury’s indebtedness – while the corresponding assets are worth far, far less than these liabilities – will solve nothing.

Debt must be reduced by defaults and bankruptcies. There is no other solution!

There’s Only One Cure For A Depression

In contrast with a depression, a recession is relatively easy to bring to an end. The genesis of a recession is caused by excessive credit creation on the part of banks and the Fed.

However, the only cure for a depression is time. Not the abrogation of the free market. The seeds of a depression are sown when an extreme over supply of money and credit is allowed to continue for a protracted period of time. When this phenomenon occurs, it produces a pernicious level of debt to pervade throughout the economy. All sectors of the economy become overleveraged and the need to reduce debt becomes paramount. The economy then experiences a severe contraction in GDP. In a depression, the pull back in borrowing is not caused by interest rate increases from the Fed but an inability of the economy to take on further debt. A depression can last for many years as consumers, banks and the government goes through the painfully long and arduous process of deleveraging.

Unfortunately, the kneejerk response on the part of the government and central bank is to stimulate the economy by spending money and reducing interest rates. That is the very same strategy used to combat a recession. However, their response fails to produce the desired result because it ignores the root cause of the problem—debt levels that have become unsustainable. It is not lower interest rates on borrowed money that the consumer seeks, it is less debt. If fact, all attempts by the government to mollify the depression tend to exacerbate the situation by force feeding more debt when it is least capable of being serviced.

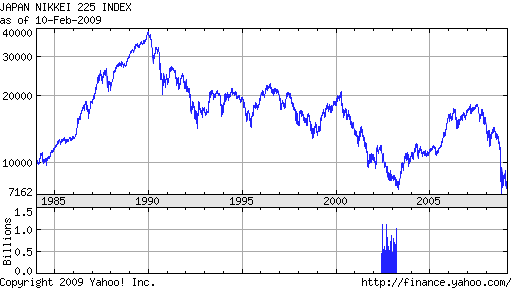

What does history say about the effectiveness of government intervention? In Japan, the Nikkei Dow hit a high of 39,957.44 on December 29th 1989. Then it’s epic real estate and equity bubble burst. The composite average is trading below 7,600 today. Even after two decades of trying to turn their market around, their government’s barrage of stimulus plans and a near zero percent interest rate policy has done little to ameliorate the malaise.

A similar result was experienced by both Herbert Hoover and Franklin Delano Roosevelt after they deployed a plethora of government interventions to combat the Great Depression. After four years of Hoover’s wealth distribution and trade wars, and five years into the New Deal, they both failed to bring the economy out of the depression. Unemployment reached 20% in the years 1937-1938 and the percent change in GDP dropped 18.2%. It wasn’t until we fought and won WWll that the economy began to enjoy a sustainable recover.

Unfortunately, we see the same playbook being deployed today as was used under the Hoover/Roosevelt regime. President Obama is following George W. Bush with the signing last week of his own stimulus plan that totals $787 billion. And of course, this is probably the first in a series of spending plans that are intended to help bring the economy back on track.

The reason all the government’s efforts fail to solve the problem is clear. Time is needed to allow asset values to retreat back to historically normal levels that can be supported by the free market. And time is necessary for debt levels to be attenuated to a level where the can be serviced without having the Fed artificially forcing interest rates down. Any and all attempts to prevent deleveraging and to prop up asset prices will cause years to be added to the healing process. Additionally, all government efforts to “help” end up becoming a huge misallocation of resources as they take capital from the private sector and redistribute it in the most inefficient manner. What’s worse is that the increased government spending adds yet more public sector debt to an economy already reeling from a mountain of liabilities.

This buildup in debt levels was unprecedented in history, thanks to a Real Estate bubble that was used to bail out an equity bubble. It would stand to reason that if the government continues to try to manufacture a recovery, it could take more than a decade to return to prosperity. The question is, do we have the patience to let the free market function and endure several years of hardship, but then emerge as a much stronger country. Or will the compulsion to intervene just propel us yet deeper into the abyss.