Irony Everywhere

Supposedly we learned certain lessons from the depression of the 1930’s. Experts agree that two of the worst policy decisions during the depression were to raise taxes and erect trade barriers.

Knowing that something is wrong and still doing it are two entirely different matters.

As the world-wide recession deepens, protectionist sentiments are rising. The House of Representatives’ version of the economic stimulus bill contains a provision that only American-made steel and other products be used for the infrastructure projects. Wrapped in the cloak of “Buy American” patriotism, the Senate version of the bill contains even stronger anti-free-trade provisions.

This Buy American momentum is bad economics, and by threatening to destabilize trade and capital flows, it risks turning a global recession into a 1930s-style depression. Asked about Buy American on Tuesday, President Barack Obama told Fox News that “we can’t send a protectionist message.” He said on ABC News that he doesn’t want anything in the stimulus bill that is “going to trigger a trade war.” He’s right.

Hostility has been no less evident in Europe and China. The European Union has said that it will not stand by idly if the U.S. violates its trade agreements and its obligations to the World Trade Organization. The risks of retaliation and a trade war are very real.

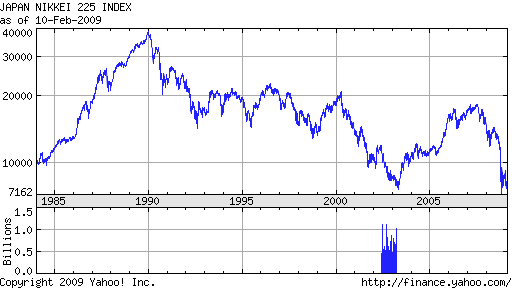

In 1930, just as the world economy was sinking as it is today, the U.S. Congress passed the Smoot-Hawley Tariff Act, which essentially shut off imports into the U.S. Our trading partners retaliated, and world trade plummeted. Most economic historians now conclude that the tariff contributed importantly to the severity of the world-wide Great Depression.

Later, as one of his last acts, President Herbert Hoover made the situation even worse by signing a “Buy America Act” requiring all federal government projects to use American materials. (That act is still on the books although it was weakened during the 1980s.) We must avoid repeating the disastrous mistakes of the past.

This is beyond idiocy and provides further proof that whatever action the government takes to “help” us is certain to hurt us. The president does not want a trade war and he probably knows that trade wars are a bad thing. Talk is cheap Mr. Obama – show some leadership and DO the right thing; politics as usual will not help us in this crisis. If there was any intellectual honesty in Washington, a “buy American” provision would have never been added to the stimulus bill. Political gamesmanship may have won someone a few votes; the economic cost to the Nation could be incalculable.

California to Close Budget Gap (With New Taxes)

Democrat Darrell Steinberg, the state Senate leader, expressed confidence that another Republican senator would join the two who have committed to vote with the Democratic majority in approving a budget that would raise taxes and cut spending.

In addition to the revenue increases, it proposed cutting $15 billion in spending, including $8.6 billion from education and $1.4 billion from payroll costs, to be achieved in part by furloughing 200,000 state workers at least one day a month. The plan also called for $11 billion in borrowing and $700 million in tax breaks for large corporations.

The impasse has revolved around a bill, out of the nearly 30 in the budget proposal, that would generate $14 billion in revenue by temporarily raising the sales tax by one percentage point, increasing the gasoline tax by 12 cents a gallon, and adding a surcharge of up to 5% on income taxes, among other steps.

Despite an unemployment rate approaching 10% California raises taxes and thus implements the same failed tax policies of the 1930’s. Considering the further impact of job cuts, pay freezes and pay cuts it is no surprise that many people can barely make ends meet. Washington’s response is a $10 a week tax cut stimulus! Bizzaro World economics in action here.

California has to take the worst action possible at the worst possible time because they have no options left. The one positive in the budget bill is that spending cuts covered part of the deficit rather than higher tax increases. Despite California’s dance on the edge of bankruptcy, few people realize the full impact that deleveraging will have on California and the nation. It will takes years of reduced spending, higher taxes and plain old fashioned frugality to restore the sound financial footing that is necessary to launch real economic growth. Politicians promising a quick turnaround based on social spending stimulus programs are apt to shortly discover the ugly side of impatient constituents.